Analyzing a company’s financials allows investors to make sound investment decisions. The information provided by financial ratios allows investors to assess the financial health of a company and make an informed decision on whether or not to invest. However, investors should remember that financial analysis is only one part of the investment decision-making process and should not be relied upon exclusively.

For example, investors should consider other factors such as the company’s market position, competitive landscape and management team. It’s no secret that analyzing a company’s financial markets provides investors with significant potential rewards, but understanding them and being able to make sound investment decisions is essential in order to take advantage of this opportunity.

For example, analyzing a company’s financials is one of the most important steps in assessing the viability of an investment, as it will determine whether a company has the ability to survive, grow and potentially produce profits for shareholders.

KEYS TAKEAWAYS:

- Analyzing a company’s financial statements is essential for making informed investment decisions.

- Financial statements include the balance sheet, income statement, and cash flow statement.

- The balance sheet provides information about the company’s assets, liabilities, and shareholders’ equity.

- The income statement shows the company’s revenue, expenses, and net income over a specific period.

- The cash flow statement details the company’s cash inflows and outflows from operating, investing, and financing activities.

- Key financial ratios such as profitability ratios, liquidity ratios, and solvency ratios can be calculated using the financial statements.

- Profitability ratios assess the company’s ability to generate profit, such as gross profit margin, operating margin, and return on equity.

- Liquidity ratios evaluate the company’s short-term financial health, including the current ratio and quick ratio.

- Solvency ratios measure the company’s long-term financial stability, such as debt-to-equity ratio and interest coverage ratio.

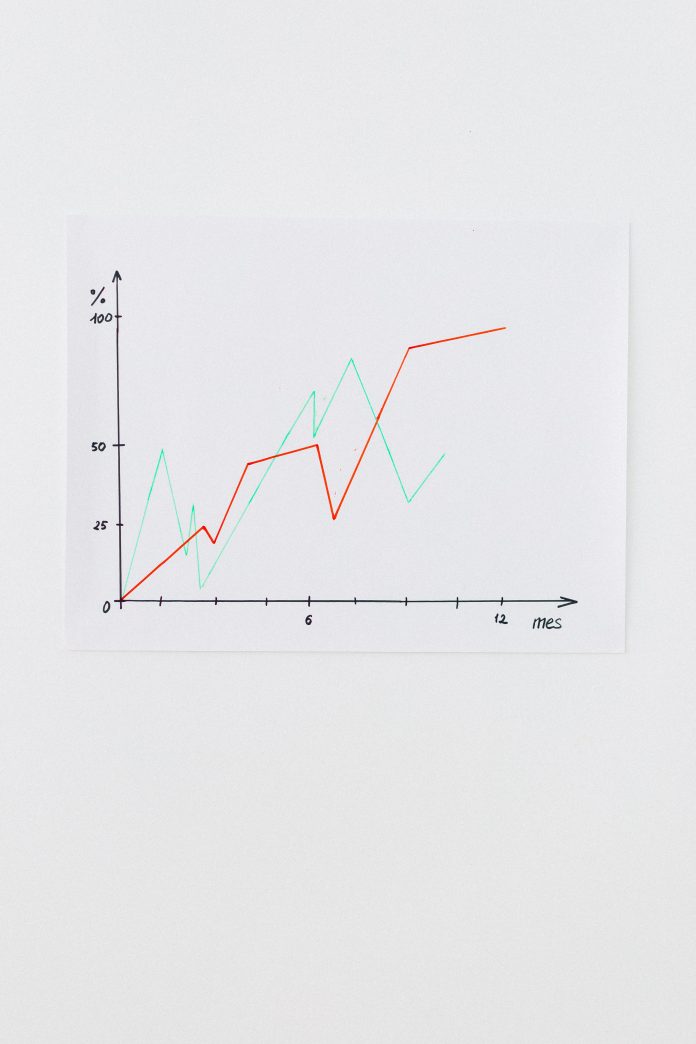

- Trend analysis can be performed by comparing financial statements over multiple periods to identify patterns or changes.

- The comparative analysis involves comparing a company’s financial performance to its competitors or industry benchmarks.

- Assessing the company’s management discussion and analysis (MD&A) section can provide insights into future prospects and risks.

- Analyzing a company’s financials should consider the industry, economic conditions, and market trends.

- It’s important to interpret financial data in conjunction with qualitative factors such as the company’s competitive position, industry outlook, and management expertise.

- Conducting thorough research and consulting with financial professionals can help in making well-informed investment decisions.

How to Analyze a Company’s Financials for Stock Investment?

Analyzing a company’s financials is a crucial step in making informed investment decisions in the stock market. Therefore, it is important to understand the basic concepts of financial analysis and how to read and interpret a company’s financial statements.

This can be a somewhat complex process, but if you take the time to understand it and use the right tools, you’ll be able to make sound investment decisions that can potentially bring you returns in the long run.

Here are some steps to help you analyze a company’s financials:

1- Analyze Management

The first step in analyzing a company’s financials is understanding the different financial statements. Generally, companies prepare four main financial statements which are the balance sheet, income statement, cash flow statement, and statement of changes in equity.

The balance sheet presents a company’s financial position at a given moment. It comprises assets (what the company owns) and liabilities (what the company owes).

2- Look at the Income Statement

The income statement tracks all revenues and expenses over a specific period of time and provides investors with a view of how profitable the company is. The cash flow statement shows the change in a company’s cash position over a specified period of time and tracks cash inflows and outflows due to operating activities, investing activities, and financing activities.

Lastly, the statement of changes in equity outlines the changes in equity of the company over a given period of time, which is useful in gauging a company’s financial performance.

3- Obtain the Financial Statements

Once you understand the differences analyze a company’s financial statements, you can begin to analyze the data. Financial ratio analysis is a common method used to analyze a company’s financials. It involves comparing different ratios to industry averages or to other companies.

This can help investors better understand a company’s performance relative to its peers and the industry.

4- Calculate Financial Ratios

Common financial ratios investors use to analyze a company’s financials include liquidity ratios, profitability ratios, solvency ratios, and financial leverage ratios. Liquidity ratios measure a company’s ability to meet short-term debt obligations and include the current ratio and quick ratio.

Profitability ratios measure a company’s ability to generate revenues and profits and include the return on assets and return on equity.

5- Solvency Ratios

Solvency ratios measure a company’s ability to cover long-term liabilities and include the debt-to-equity ratio and interest coverage ratio. Financial leverage ratios measure the capital structure of a company and include the debt-to-asset ratio and the debt-to-equity ratio.

6- Examine the Balance Sheet

The balance sheet provides a snapshot of the company’s assets, liabilities, and equity at a specific point in time. Look for trends in the company’s assets, liabilities, and equity to determine if the company is financially stable.

7- Review the Cash Flow Statement

The cash flow statement shows how the company generates and uses cash. Analyze the cash flow from operations, investing activities, and financing activities. Pay attention to the trends in cash flow to identify any potential problems.

The cash flow statement is a financial statement that provides an overview of the inflows and outflows of cash and cash equivalents of a company over a specific period of time. It is an important tool for investors, creditors, and other stakeholders to assess the liquidity and financial health of the company.

There are three main sections of a cash flow statement:

- Operating activities: This section shows the cash inflows and outflows from the company’s primary business operations. It includes cash received from customers, payments made to suppliers and employees, and other expenses related to running the business.

- Investing activities: This section shows the cash inflows and outflows from the company’s investments in long-term assets, such as property, plant, and equipment. It also includes cash received from the sale of investments and other assets.

- Financing activities: This section shows the cash inflows and outflows related to the company’s financing activities, such as issuing and repaying debt, issuing and buying back stock, and paying dividends.

8-Compare to Industry Benchmarks

It’s important to compare and analyze a company’s financials to industry benchmarks to assess its performance relative to its peers. This can help investors identify whether a company is overvalued or undervalued.

Comparing to industry benchmarks involves measuring a company’s performance against the standards or averages set by other companies in the same industry. It is a useful way to assess whether a company is performing well, and it can highlight areas where improvements can be made.

9-Evaluate Management and Growth Prospects

Lastly, investors should evaluate the company’s management team and growth prospects. Factors such as the company’s competitive position, industry trends, and future growth opportunities should be taken into consideration.

If you are looking to learn more about analyzing a company’s financials, Investopedia is a great resource. Additionally, there are a number of online tools that can help you make sense of financial statements and calculate ratios. Some of these tools include Stock Rover, YCharts, and the Financial Management Kit.

Conclusion

In conclusion, analyzing a company’s financials is an important step in making sound investment decisions. It allows investors to assess a company’s financial health and make an informed decision on whether or not to invest.

While it can be a complex process, understanding the basics of financial analysis and using online tools can help investors make sound investment decisions in the long run.

Other Resources

Online Resources that are helpful to carry out this research or put it into action:

1. Investopedia: https://www.investopedia.com/

2. Stock Rover: https://www.stockrover.com/

3. YCharts: https://ycharts.com/

4. Financial Management Kit: https://www.investinginbonds.com/library/financial-management-kit.aspx