Breaking down the balance sheet is a snapshot of the financial status of a company and provides essential information about the company’s assets, liabilities, and equity. It can help you identify any potential red flags and make more informed decisions when it comes to investing. You can also check a comprehensive guide to evaluate a company’s health before investing in stocks.

Understanding a balance sheet can seem overwhelming at first, but it doesn’t have to be. In this article, we’ll provide a beginner’s guide for stock investors on how to read a balance sheet. We’ll explain the basics of a balance sheet, provide a few tips and tricks for analyzing one, and offer some actionable guides on how to read a balance sheet. So let’s get started!

What is a Balance Sheet?

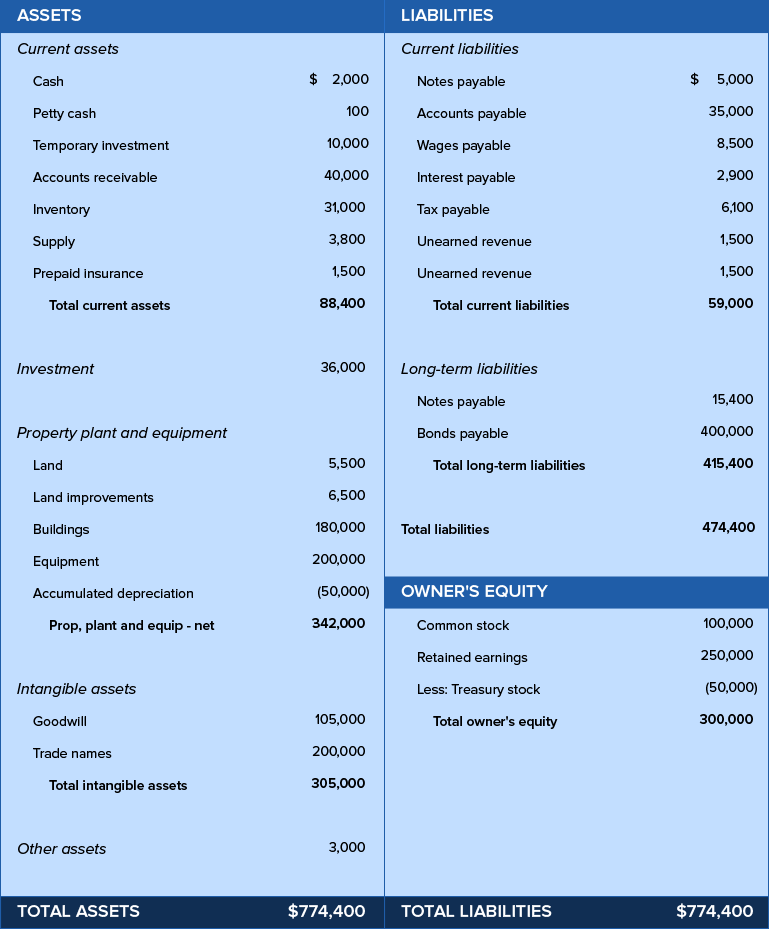

It is financial statement that shows a company’s assets, liabilities, and equity at a given point in time. Assets represent things of value that the company owns, such as cash, accounts receivable, and inventory. Liabilities are debts and other obligations the company has, such as accounts payable and loans. Equity is the portion of the company that is owned by its shareholders.

The Fundamentals of Balance Sheet

It follows the basic accounting equation that states that a company’s assets must always equal its liabilities plus equity. This equation forms the basis of double-entry accounting, which is the standard method used to record financial transactions.

Here’s how it works:

- Here’s how it works: every financial transaction has two sides, a debit and a credit. When a company acquires an asset, it records a debit to its asset account and a credit to another account, typically cash or accounts payable. When a company takes on a liability, it records a credit to its liability account and a debit to another account, typically cash or accounts receivable. Equity is affected by revenues, expenses, and other gains or losses that are recorded on the income statement.

- The sheet is divided into three main sections: assets, liabilities, and equity. The assets section includes everything a company owns that has value, such as cash, investments, property, equipment, and inventory. The liabilities section includes everything a company owes to others, such as loans, accounts payable, and taxes owed. Equity includes everything that is left over after liabilities are subtracted from assets.

- The assets section is divided into two categories: current assets and long-term assets. Current assets are those that can be converted into cash within a year or less, such as cash, accounts receivable, and inventory. Long-term assets, also known as fixed assets, are those that are held for more than a year, such as property, plant, and equipment.

- The liabilities section is also divided into two categories: current liabilities and long-term liabilities. Current liabilities are those that are due within a year or less, such as accounts payable and taxes owed. Long-term liabilities, also known as non-current liabilities, are those that are due after a year or more, such as long-term debt and deferred taxes.

- Equity is the residual value of a company’s assets after its liabilities are subtracted. It includes both contributed capital, which is the amount of money shareholders have invested in the company, and retained earnings, which are the profits that the company has earned but has not distributed as dividends.

Importance of the Balance Sheet

This is a critical tool for investors, creditors, and other stakeholders who want to assess a company’s financial health. It provides information about a company’s assets, liabilities, and equity, which can be used to evaluate its solvency, liquidity, and overall financial position.

Investors can use the balance sheet to assess a company’s ability to pay its debts, invest in growth opportunities, and generate long-term value for shareholders. Creditors can use the sheet to assess a company’s creditworthiness and ability to repay loans. Other stakeholders, such as regulators and tax authorities, can use the sheet to ensure compliance with applicable laws and regulations. Along with the balance sheet, there are also other critical factors that you should check before investing in stocks.

How to Read a Balance Sheet

Here is a beginner’s guide to reading a balance sheet:

1. Understand the Three Main Components

The sheet is divided into three main components – assets, liabilities, and equity.

- Assets are what a company owns.

- Liabilities are what it owes.

- And equity is the difference between the two.

Type of Assets

There are various types of assets, including:

- Current Assets: Assets that can be converted into cash or used up within a year, such as cash, accounts receivable, inventory, and prepaid expenses.

- Fixed Assets: Assets that are expected to be used for more than one year, such as property, plant, and equipment.

- Intangible Assets: Assets that lack physical substance but have value, such as patents, trademarks, copyrights, and goodwill.

- Financial Assets: Assets that represent a claim on the assets or income of another entity, such as stocks, bonds, and derivatives.

- Natural Resources: Assets that are extracted from the earth, such as oil, gas, and minerals.

- Other Assets: Assets that do not fall into any of the above categories, such as deferred tax assets and investments in other companies.

Type of Liabilities

- Current liabilities: These are debts and obligations that are expected to be settled within one year or within the normal operating cycle of a business. Examples of current liabilities include accounts payable, short-term loans, taxes owed, and accrued expenses.

- Long-term liabilities: These are debts and obligations that are not due within one year or the normal operating cycle of a business. Long-term liabilities may include things like long-term loans, lease obligations, and pension obligations.

2. Know the Basic Formula of the Balance Sheet:

This means that a company’s assets are always equal to its liabilities plus equity.

Balance Sheet Formula

Asset = Liabilities + Equity

3. Analyze the Assets Section

To begin reading a balance sheet, start by looking at the assets side. This includes cash and cash equivalents, short-term investments, accounts receivable, inventory, fixed assets (such as buildings, equipment, and machinery), and other assets.

The assets section is divided into current and non-current assets. Current assets are assets that can be easily converted into cash within one year, such as inventory, accounts receivable, and cash. Non-current assets are assets that cannot be easily converted into cash, such as property, plant, and equipment.

Tips and Tricks for Analyzing a Balance Sheet

When analyzing a balance sheet, it can be helpful to compare it to others in the same industry. This will give you a better understanding of how the company is doing compared to its peers.

- Keep an eye on trends: It’s also important to look at the trend in the figures over time. If a company’s cash balance has decreased consistently over the past few years, it could be a sign that the company is having cash flow problems. Similarly, if the company’s accounts receivable balance has increased over the same period of time, it could be a sign that the company is having trouble collecting payments from its customers.

- Check out the ratios: You should also keep an eye on the ratio of assets to liabilities. This will help you determine if the company has enough funds to cover its liabilities. A higher ratio indicates that the company has more funds than it needs to cover its liabilities, while a lower ratio indicates the company may be in financial trouble.

- Start with the basics: Before diving into the details, make sure you understand the basic structure of a balance sheet, including its assets, liabilities, and equity.

- Look at the big picture: Take a step back and look at the overall financial health of the company. Check for trends in revenue and profitability, as well as any significant changes in the balance sheet over time.

- Analyze liquidity: Evaluate the company’s ability to meet its short-term obligations by looking at the current ratio, quick ratio, and cash conversion cycle.

- Assess solvency: Determine whether the company has the resources to meet its long-term obligations by examining the debt-to-equity ratio, interest coverage ratio, and debt service coverage ratio.

- Scrutinize asset quality: Investigate the quality of the company’s assets, including its inventory, accounts receivable, and property, plant, and equipment.

- Evaluate profitability: Review the company’s profitability ratios, such as gross margin, net profit margin, and return on equity, to assess its ability to generate profits from its operations.

- Consider management quality: Examine the quality of the company’s management team and its ability to make sound financial decisions that benefit the company and its shareholders.

- Compare to industry benchmarks: Compare the company’s financial ratios to industry benchmarks to get a sense of how it stacks up against its competitors.

- Watch out for red flags: Be on the lookout for any warning signs that could indicate financial trouble, such as declining profitability, increasing debt levels, or inadequate cash reserves.

- Ask questions: Don’t be afraid to ask questions or seek clarification on anything that is unclear or confusing. Doing so can help you gain a better understanding of the company’s financial position and make more informed investment decisions.

Example

For Example: Let’s say you’re looking at the balance sheet of ABC Company. On the assets side, you see that the company has $100,000 in cash, $50,000 in accounts receivable, and $200,000 in inventory. On the liabilities side, you see that the company has $40,000 in accounts payable and $50,000 in long-term debt. On the equity side, you see that the company has $100,000 in retained earnings and $150,000 in common stock.

Looking at the company’s assets and liabilities over time, you see that the cash balance has been decreasing steadily, while the accounts receivable balance has been increasing steadily. This could be a sign that the company is having trouble collecting payments from its customers.

Using the asset-to-liability ratio, you see that the company has $290,000 in assets and $90,000 in liabilities, giving it a ratio of 3.2. This shows that the company has enough funds to cover its liabilities and is financially stable.

Conclusion

A balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a given point in time. It follows the basic accounting equation that states that a company’s assets must always equal its liabilities plus equity. This equation forms the basis of double-entry accounting, which is the standard method used to record financial transactions. Investors can use the balance sheet to assess a company’s ability to pay its debts, invest in growth opportunities, and generate long-term value for shareholders.

Check out our website for more amazing tips and related articles.

[…] The first step to take when evaluating a company’s financial health is to analyze its financial reports. This includes reviewing its income statement, balance sheet, and cash flow statement. These reports provide a detailed look at the company’s income, expenses, assets, liabilities, and how well it is able to generate cash. They also provide insight into how well the company is managed and how it is performing in the market. Read further on how to read a balance sheet. […]